Small businesses across the United States have relied on the Paycheck Protection Program (PPP) to navigate the financial challenges posed by the pandemic. PPP loan forgiveness is a critical aspect of this program, enabling eligible businesses to have their loans forgiven if they meet specific criteria. As the program evolves, understanding the PPP loan forgiveness list and its requirements is more important than ever. This article will provide an in-depth exploration of the PPP loan forgiveness process, helping you navigate the complexities of loan forgiveness.

Business owners often find themselves overwhelmed by the intricacies of PPP loan forgiveness. With numerous guidelines, documentation requirements, and deadlines, ensuring compliance can be a daunting task. This guide aims to simplify the process and empower you with the knowledge needed to maximize your chances of loan forgiveness.

Whether you're a first-time PPP borrower or looking to optimize your second-draw PPP loan, this comprehensive resource will cover everything you need to know. From eligibility criteria to the latest updates on the PPP loan forgiveness list, we'll break down the key aspects of this program in an easy-to-understand format.

Read also:Ally Mcgraw A Journey Through Her Iconic Career And Personal Life

Understanding PPP Loan Forgiveness: A Detailed Overview

The Paycheck Protection Program (PPP) was established under the CARES Act to provide financial relief to small businesses affected by the pandemic. One of the most appealing features of this program is the potential for loan forgiveness. By adhering to specific guidelines, businesses can have their PPP loans forgiven, effectively turning them into grants.

What Is PPP Loan Forgiveness?

PPP loan forgiveness refers to the process by which a PPP loan is discharged if the borrower uses the funds for eligible expenses and meets other requirements. Eligible expenses include payroll costs, rent, utilities, and mortgage interest. The forgiveness process is designed to encourage businesses to retain employees and maintain operational stability during challenging times.

- Payroll costs account for at least 60% of forgivable expenses.

- Non-payroll expenses such as rent, utilities, and mortgage interest can make up the remaining 40%.

- Businesses must demonstrate that they have maintained or restored their workforce to qualify for full forgiveness.

Eligibility Criteria for PPP Loan Forgiveness

To qualify for PPP loan forgiveness, businesses must meet specific eligibility criteria. These criteria are designed to ensure that the funds are used for their intended purpose and that businesses adhere to the program's guidelines.

Key Requirements for Forgiveness

Here are the primary requirements businesses must satisfy to achieve PPP loan forgiveness:

- Use of Funds: Borrowers must use at least 60% of the loan amount on payroll costs.

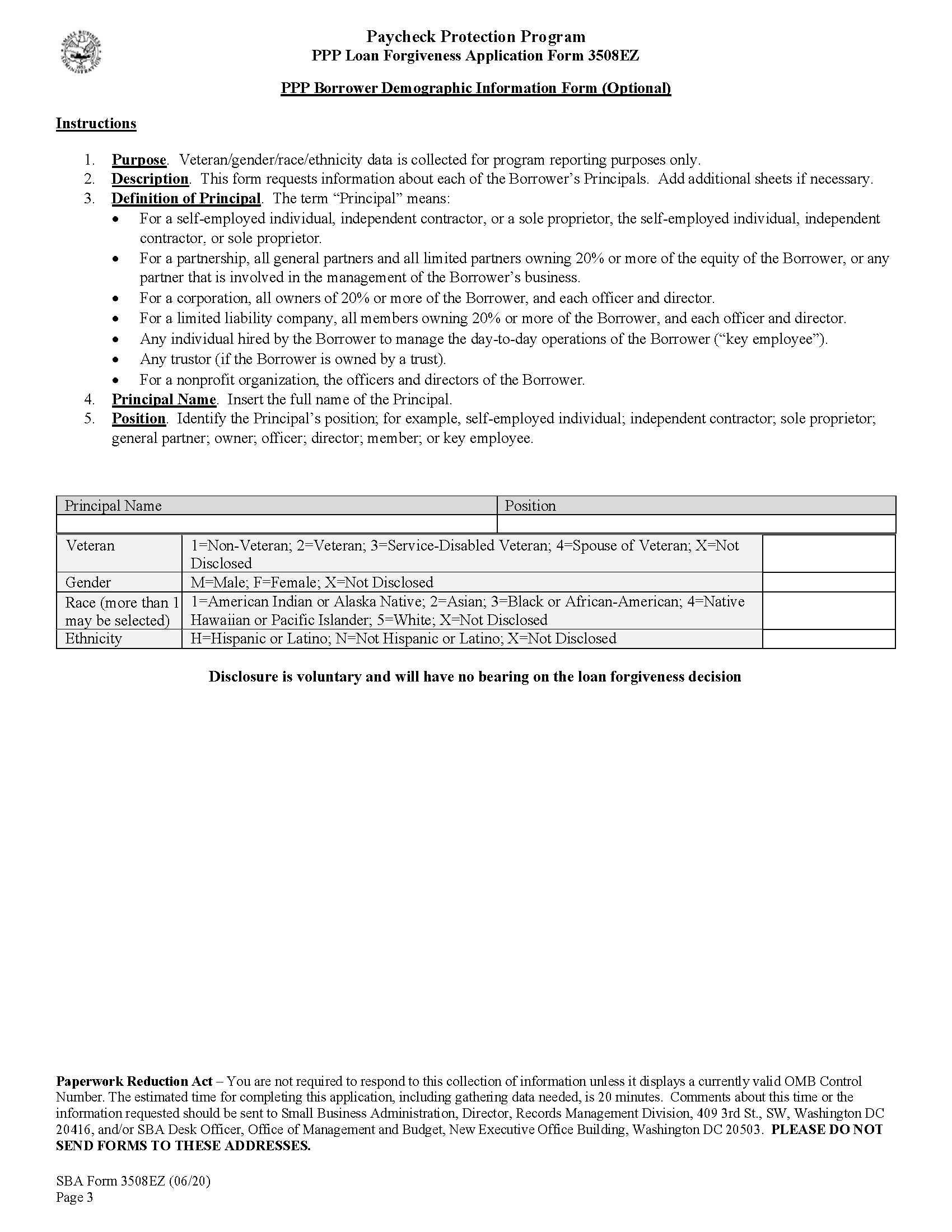

- Documentation: Businesses must provide detailed documentation of eligible expenses.

- Workforce Maintenance: Borrowers must maintain or restore their pre-pandemic workforce levels.

PPP Loan Forgiveness List: An Updated Perspective

The PPP loan forgiveness list provides a comprehensive overview of businesses that have successfully obtained loan forgiveness. This list is regularly updated by the Small Business Administration (SBA) and serves as a valuable resource for businesses seeking guidance on the forgiveness process.

How to Access the PPP Loan Forgiveness List

Businesses can access the PPP loan forgiveness list through the SBA's official website. The list includes details such as the borrower's name, loan amount, and forgiveness status. It is important to note that the list only includes loans above a certain threshold, as mandated by privacy regulations.

Read also:Patricia Arquette A Journey Through Her Iconic Career And Personal Life

Documentation Requirements for PPP Loan Forgiveness

Proper documentation is essential for achieving PPP loan forgiveness. Borrowers must gather and submit specific documents to demonstrate compliance with the program's guidelines.

Types of Documentation Needed

- Payroll records, including tax forms and employee payment records.

- Lease agreements and utility bills to verify eligible non-payroll expenses.

- Proof of workforce maintenance, such as employee headcount reports.

By ensuring all necessary documentation is organized and readily available, businesses can streamline the forgiveness process and reduce the risk of delays or rejections.

Common Mistakes to Avoid in the Forgiveness Process

Many businesses encounter obstacles during the PPP loan forgiveness process due to common mistakes. Understanding these pitfalls can help borrowers avoid unnecessary complications.

Avoiding Pitfalls in PPP Loan Forgiveness

- Failing to maintain accurate records of eligible expenses.

- Not adhering to the 60/40 rule for payroll and non-payroll expenses.

- Missing deadlines for submitting forgiveness applications.

By staying vigilant and adhering to the program's guidelines, businesses can increase their chances of successful loan forgiveness.

Updates and Changes to PPP Loan Forgiveness Guidelines

The PPP program has undergone several updates and changes since its inception. Staying informed about these updates is crucial for businesses seeking loan forgiveness.

Recent Changes to PPP Loan Forgiveness

Recent updates to the PPP loan forgiveness guidelines include:

- Extended deadlines for submitting forgiveness applications.

- Clarifications on eligible expenses and documentation requirements.

- Enhanced flexibility for businesses affected by ongoing economic challenges.

Businesses should regularly review updates from the SBA to ensure compliance with the latest regulations.

Expert Tips for Maximizing PPP Loan Forgiveness

Maximizing PPP loan forgiveness requires strategic planning and attention to detail. Here are some expert tips to help businesses optimize their forgiveness applications:

Strategies for Successful Forgiveness

- Engage with a qualified accountant or financial advisor to ensure compliance with guidelines.

- Regularly review the SBA's resources and updates to stay informed about program changes.

- Utilize forgiveness calculators and tools to simplify the application process.

By leveraging these strategies, businesses can enhance their chances of achieving full loan forgiveness.

Resources and Tools for PPP Loan Forgiveness

Several resources and tools are available to assist businesses with the PPP loan forgiveness process. These resources can help streamline the application process and ensure compliance with program guidelines.

Useful Resources for PPP Loan Forgiveness

- SBA PPP Loan Forgiveness Portal: A comprehensive resource for forgiveness applications and updates.

- IRS PPP Loan Forgiveness FAQs: Answers to frequently asked questions about the forgiveness process.

- Forgiveness calculators: Online tools that help businesses estimate their forgiveness amounts.

Utilizing these resources can significantly simplify the forgiveness process and improve the likelihood of success.

Case Studies: Successful PPP Loan Forgiveness Examples

Examining case studies of successful PPP loan forgiveness applications can provide valuable insights for businesses. These examples demonstrate how businesses have effectively navigated the forgiveness process.

Real-World Examples of PPP Loan Forgiveness

Case Study 1: A small retail business successfully achieved loan forgiveness by maintaining accurate records and adhering to the 60/40 rule.

Case Study 2: A restaurant owner restored their workforce levels and provided detailed documentation of eligible expenses to secure full forgiveness.

These examples highlight the importance of meticulous planning and compliance with program guidelines.

Conclusion: Take Action for Your Business

In conclusion, understanding the PPP loan forgiveness list and the associated guidelines is crucial for businesses seeking financial relief. By adhering to eligibility criteria, maintaining accurate documentation, and staying informed about program updates, businesses can maximize their chances of successful loan forgiveness.

We encourage you to take action by reviewing your eligibility, gathering necessary documentation, and submitting your forgiveness application promptly. Share your thoughts and experiences in the comments below, and explore our other resources for additional guidance on navigating the PPP program.

Table of Contents

- Understanding PPP Loan Forgiveness: A Detailed Overview

- Eligibility Criteria for PPP Loan Forgiveness

- PPP Loan Forgiveness List: An Updated Perspective

- Documentation Requirements for PPP Loan Forgiveness

- Common Mistakes to Avoid in the Forgiveness Process

- Updates and Changes to PPP Loan Forgiveness Guidelines

- Expert Tips for Maximizing PPP Loan Forgiveness

- Resources and Tools for PPP Loan Forgiveness

- Case Studies: Successful PPP Loan Forgiveness Examples

- Conclusion: Take Action for Your Business