The basic allowance for housing (BAH) rates navy is a critical component of compensation for active-duty service members, designed to offset the cost of housing expenses when government quarters are unavailable. It ensures that service members can maintain a stable living environment without undue financial strain. Understanding BAH rates is essential for anyone considering or currently serving in the Navy, as it directly impacts personal finances and quality of life.

For many sailors, the BAH rate serves as a safety net, allowing them to focus on their duties without worrying about housing costs. The Navy BAH rates are calculated based on several factors, including rank, duty location, and the number of dependents. These rates are updated annually to reflect changes in the housing market and inflation.

This guide will delve into the intricacies of Navy BAH rates, providing detailed insights into how they are calculated, the factors that influence them, and strategies to maximize benefits. Whether you're a new recruit or a seasoned sailor, understanding BAH rates is crucial for financial planning and stability.

Read also:Is James Taylor Still Touring Exploring The Musical Legends Current Performances

Table of Contents

- Introduction to Navy BAH Rates

- How Navy BAH Rates Are Calculated

- Factors Influencing Navy BAH Rates

- BAH Rates with Dependents

- BAH Rates Without Dependents

- Tax Implications of Navy BAH Rates

- Annual Updates to Navy BAH Rates

- Resources for Understanding Navy BAH Rates

- Frequently Asked Questions About Navy BAH Rates

- Conclusion

Introduction to Navy BAH Rates

Understanding the Navy BAH rates system is pivotal for any service member. The Basic Allowance for Housing (BAH) is a non-taxable benefit designed to help offset the cost of housing for service members who do not live in government quarters. This allowance ensures that sailors can maintain a standard of living commensurate with their rank and responsibilities.

BAH rates navy vary based on geographic location, as housing costs differ significantly across the United States. For instance, living in a major metropolitan area like San Francisco will incur higher BAH rates compared to a smaller town in the Midwest. The Department of Defense (DoD) regularly surveys housing markets to adjust these rates accordingly, ensuring they remain relevant and fair.

Service members without dependents receive a different rate compared to those with dependents, reflecting the varying housing needs of each group. This system aims to provide equitable support, recognizing the additional financial burdens that come with supporting a family.

How Navy BAH Rates Are Calculated

The calculation of Navy BAH rates involves a detailed analysis of housing costs in specific areas. The DoD employs a team of experts who gather data on rental prices, utility costs, and other housing-related expenses. This data is then used to determine the appropriate BAH rate for each location.

Rank and Pay Grade

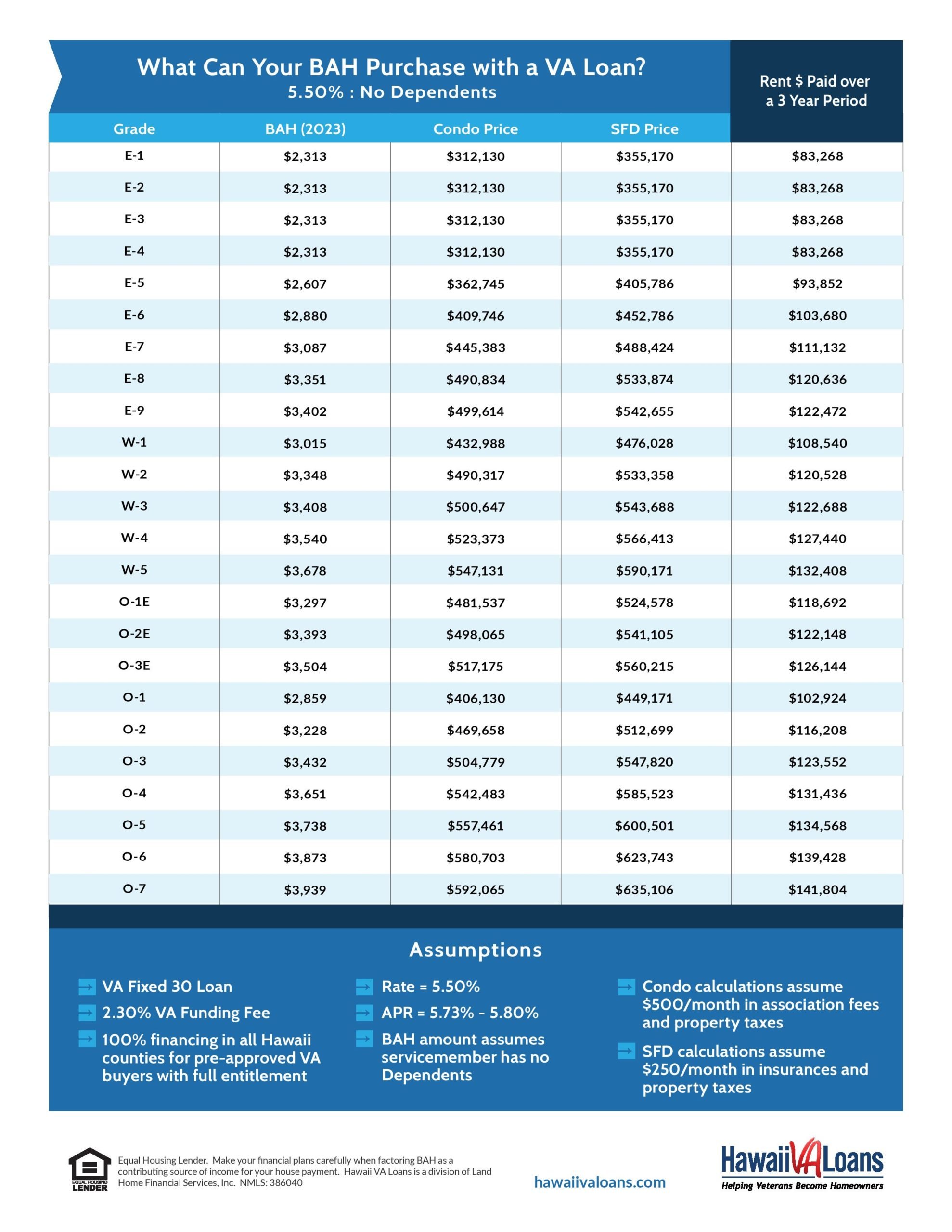

One of the primary factors in calculating BAH rates is the service member's rank or pay grade. Higher ranks typically receive higher BAH rates, reflecting their greater responsibility and often higher housing needs. For example, an E-5 (Petty Officer 2nd Class) will have a different rate compared to an O-6 (Captain).

Location-Based Adjustments

Location plays a crucial role in determining BAH rates. The DoD uses a detailed survey of rental prices in each area to establish rates that accurately reflect local market conditions. This ensures that service members receive adequate support regardless of where they are stationed.

Read also:Comprehensive Guide To Navy Rates And Ranks Understanding The Structure And Hierarchy

Factors Influencing Navy BAH Rates

Several key factors influence Navy BAH rates, each contributing to the overall calculation and adjustment of these allowances. Understanding these factors can help service members better plan their finances and anticipate changes in their BAH rates.

Geographic Location

As mentioned earlier, geographic location is a significant factor. Areas with higher living costs, such as coastal cities or major metropolitan areas, command higher BAH rates. Conversely, regions with lower housing costs receive proportionally lower rates.

Number of Dependents

Service members with dependents receive a higher BAH rate to account for the additional space and resources needed for a family. This adjustment reflects the increased financial burden of supporting a household.

Market Trends

Housing market trends, such as changes in rental prices and availability, also impact BAH rates. The DoD continuously monitors these trends to ensure BAH rates remain relevant and supportive.

BAH Rates with Dependents

Service members with dependents receive a higher BAH rate to accommodate their increased housing needs. This adjustment recognizes the additional expenses associated with supporting a family, including larger living spaces and higher utility costs.

BAH rates navy for those with dependents are calculated based on the assumption of needing a three-bedroom home. This ensures that service members can provide adequate living conditions for their families without excessive financial strain.

Additional Benefits

- Higher BAH rates to cover larger living spaces

- Support for additional utilities and maintenance costs

- Access to family-oriented housing options

BAH Rates Without Dependents

Service members without dependents receive a different BAH rate, typically lower than those with dependents. This rate is calculated based on the assumption of needing a one-bedroom apartment or similar housing option.

The BAH rates navy for single service members aim to provide a comfortable living environment without unnecessary expenses. These rates are adjusted annually to reflect changes in housing markets and inflation.

Key Considerations

- Lower BAH rates compared to those with dependents

- Focus on single-person housing options

- Regular updates to ensure affordability

Tax Implications of Navy BAH Rates

One of the advantages of Navy BAH rates is their non-taxable status. Service members do not have to pay federal income tax on their BAH allowance, making it a valuable component of their overall compensation package.

This tax-free status is part of the Department of Defense's effort to support service members financially. By eliminating the tax burden on housing allowances, the DoD ensures that sailors can allocate more resources toward other essential expenses.

State Tax Variations

While BAH is federally tax-free, some states may impose their own taxes on this allowance. Service members should consult with a tax professional or their finance office to understand any potential state tax implications.

Annual Updates to Navy BAH Rates

BAH rates are updated annually to reflect changes in housing markets and inflation. The DoD conducts extensive research and surveys to ensure these updates accurately represent current housing costs.

These updates typically occur at the beginning of the year, providing service members with a clear understanding of their housing allowance for the upcoming year. The BAH rates navy are published well in advance, allowing sailors to plan accordingly.

Key Updates for 2024

- Average increase of 4.5% across all locations

- Focus on high-cost areas for additional adjustments

- Improved data collection methods for more accurate rates

Resources for Understanding Navy BAH Rates

Several resources are available to help service members understand and maximize their Navy BAH rates. These resources provide detailed information on how BAH rates are calculated, updated, and applied.

The official Department of Defense BAH website offers comprehensive guides, calculators, and FAQs to assist sailors in navigating the BAH system. Additionally, service members can consult with their finance offices for personalized guidance and support.

Recommended Resources

- DoD BAH Official Website

- Finance Office Support

- Service Member Forums and Communities

Frequently Asked Questions About Navy BAH Rates

Here are some common questions and answers regarding Navy BAH rates:

Q: Can I use my BAH allowance for any type of housing?

A: Yes, BAH can be used for any type of housing, including renting or purchasing a home. However, the allowance is designed to cover typical housing expenses, so any excess costs must be covered by the service member.

Q: What happens if I move to a new duty station?

A: Your BAH rate will be updated based on the new location's housing costs. This adjustment ensures that you receive adequate support regardless of where you are stationed.

Q: Are BAH rates the same for all branches of the military?

A: Yes, BAH rates are standardized across all branches of the military, ensuring equitable support for all service members.

Conclusion

Understanding Navy BAH rates is essential for any service member seeking financial stability and security. By familiarizing yourself with how these rates are calculated, the factors that influence them, and the resources available for support, you can make informed decisions about your housing options.

We encourage you to take advantage of the resources provided by the Department of Defense and your finance office to maximize your BAH benefits. Share this article with fellow service members and explore other guides on our site for further insights into military compensation and benefits.