When it comes to military housing allowances, understanding how much the military pays for housing is crucial for service members and their families. The military offers a Basic Allowance for Housing (BAH) to help cover the cost of housing for those who do not live on base. This allowance varies depending on factors such as rank, location, and dependents. In this article, we will explore the intricacies of military housing payments, ensuring you have all the necessary information to make informed decisions.

Housing is one of the most significant expenses for military personnel, and the BAH program plays a vital role in supporting service members. This article delves into the details of how much the military pays for housing, the factors that influence housing allowances, and how to maximize your benefits.

Whether you're a new recruit or a veteran, understanding the financial aspects of military housing is essential. By the end of this guide, you'll have a clear understanding of how the BAH system works and how it can benefit you and your family.

Read also:Eagle Tattoo Ideas A Comprehensive Guide To Creating Your Perfect Tattoo

Table of Contents

- What is Basic Allowance for Housing (BAH)?

- Factors Affecting BAH Rates

- BAH Rates by Rank

- Location-Based BAH Rates

- BAH with Dependents

- BAH Without Dependents

- Tax Implications of BAH

- How to Claim BAH

- Common Mistakes to Avoid

- Conclusion

What is Basic Allowance for Housing (BAH)?

The Basic Allowance for Housing (BAH) is a tax-free housing stipend provided to military personnel who do not reside in government-provided housing. This allowance is designed to cover the cost of housing in the private sector. BAH ensures that service members can afford suitable housing without financial strain.

Key Features of BAH

- BAH is non-taxable income, which means it does not count as part of your taxable income.

- The allowance is updated annually to reflect changes in local housing costs.

- Service members can use BAH to rent or purchase a home, depending on their needs.

The BAH program is one of the most important financial benefits for military personnel, offering stability and support for housing expenses.

Factors Affecting BAH Rates

Several factors determine how much the military pays for housing through BAH. Understanding these factors is essential for maximizing your housing allowance. Below are the primary considerations:

Military Rank

Your military rank significantly impacts your BAH rate. Higher-ranking personnel typically receive higher allowances to reflect their greater responsibilities and potential housing needs.

Location

BAH rates vary depending on the cost of living in your duty station area. Urban areas with higher housing costs will generally have higher BAH rates than rural areas.

Read also:Is James Taylor Still Touring Exploring The Musical Legends Current Performances

Dependent Status

Service members with dependents receive a higher BAH rate than those without dependents. This adjustment acknowledges the additional housing needs of families.

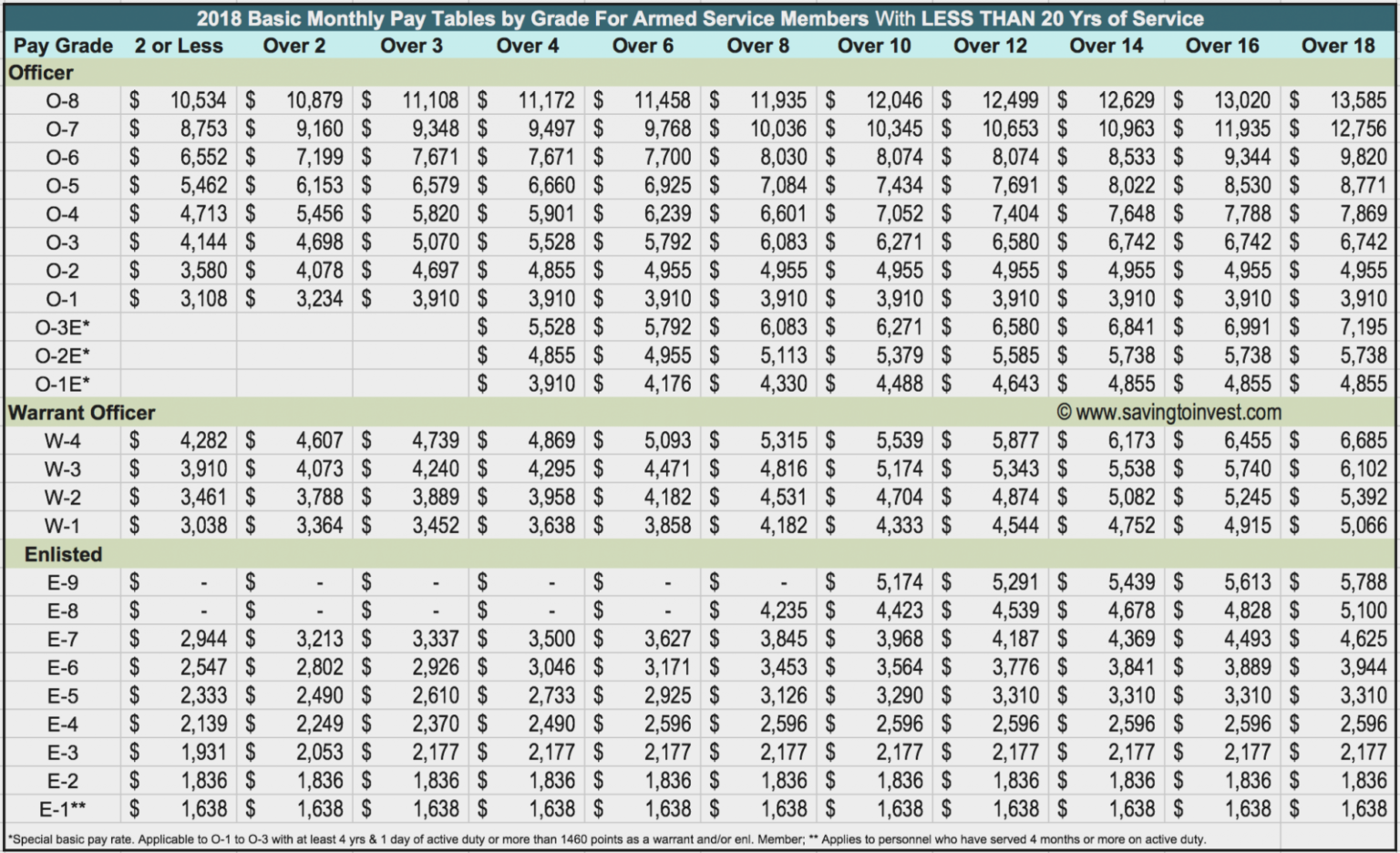

BAH Rates by Rank

BAH rates are structured according to military rank. Below is a breakdown of typical BAH rates for enlisted personnel and officers as of 2023:

Enlisted Personnel

- E-1: $1,000 - $1,500 per month (varies by location)

- E-5: $1,800 - $2,300 per month

- E-7: $2,400 - $3,000 per month

Officers

- O-1: $2,000 - $2,500 per month

- O-3: $2,800 - $3,300 per month

- O-6: $3,500 - $4,200 per month

These figures are illustrative and may vary based on location and dependent status.

Location-Based BAH Rates

Location is one of the most significant factors affecting BAH rates. The Department of Defense regularly updates BAH rates to align with local housing market conditions. For example:

Urban Areas

Cities like San Francisco, New York, and Washington D.C. have some of the highest BAH rates due to their expensive housing markets. In these areas, service members may receive BAH rates exceeding $4,000 per month.

Rural Areas

In contrast, rural areas often have lower BAH rates. For example, duty stations in parts of the Midwest or South may offer BAH rates closer to $1,200 per month.

How Rates Are Calculated

BAH rates are calculated based on data collected from housing surveys and real estate market analysis. The goal is to ensure that service members can afford median rental costs in their area.

BAH with Dependents

Service members with dependents receive a higher BAH rate to account for the additional space and resources required for families. The increase in BAH with dependents can range from 10% to 25%, depending on rank and location.

Eligibility for BAH with Dependents

- Service members must have a legal dependent, such as a spouse or child, to qualify for the higher rate.

- Documentation, such as marriage certificates or birth certificates, may be required to prove dependents.

BAH Without Dependents

Service members without dependents receive a lower BAH rate. While this rate is still substantial, it reflects the smaller housing needs of single service members. For example:

- E-5 without dependents: $1,800 per month

- O-3 without dependents: $2,800 per month

Even without dependents, BAH provides a valuable financial benefit for housing expenses.

Tax Implications of BAH

One of the most significant advantages of BAH is that it is non-taxable income. Unlike traditional income, BAH is not subject to federal or state income taxes. This tax-free status allows service members to allocate more of their housing allowance toward actual housing costs.

Additional Tax Benefits

- Service members can use BAH to invest in property purchases without worrying about tax liabilities.

- For those renting, the full BAH amount can be used to cover rent without additional tax deductions.

How to Claim BAH

Claiming BAH is a straightforward process, but it requires attention to detail. Here's how you can ensure you receive your housing allowance:

Steps to Claim BAH

- Verify your eligibility based on rank, location, and dependent status.

- Submit the necessary paperwork to your unit's finance office.

- Ensure your duty station address is up to date in the military's records.

BAH payments are typically deposited directly into your bank account on a monthly basis, just like your regular military pay.

Common Mistakes to Avoid

While BAH is a valuable benefit, some service members make mistakes that can reduce their housing allowance. Here are a few common pitfalls to avoid:

Incorrect Address

Ensure your duty station address is accurate. An incorrect address can lead to incorrect BAH calculations.

Failure to Update Dependent Status

If you gain or lose a dependent, update your records promptly to reflect the change in your BAH rate.

Not Understanding Local Housing Costs

Research local housing costs before moving to a new duty station. This will help you make informed decisions about housing options within your BAH budget.

Conclusion

Understanding how much the military pays for housing through the Basic Allowance for Housing (BAH) program is essential for service members and their families. BAH provides financial stability and support for housing expenses, ensuring that military personnel can focus on their duties without worrying about where they will live.

Key Takeaways:

- BAH rates vary based on rank, location, and dependent status.

- The allowance is non-taxable, offering significant financial benefits.

- Service members can use BAH to rent or purchase a home, depending on their preferences.

We encourage you to take full advantage of the BAH program by understanding your eligibility and maximizing your benefits. If you have questions or need further clarification, feel free to leave a comment below or consult your unit's finance office. Share this article with fellow service members to help them make informed decisions about their housing needs.

Thank you for reading, and remember, knowledge is power when it comes to managing your military housing allowance.