Health insurance is an essential component of modern life, providing financial protection and peace of mind when it comes to medical expenses. Among the many options available, first choice health insurance plans stand out as the ideal solution for individuals and families seeking comprehensive coverage. These plans offer a wide range of benefits, ensuring that policyholders receive the medical care they need without breaking the bank. Whether you're looking for preventive care, hospitalization coverage, or prescription medication, first choice health insurance plans are designed to meet your unique healthcare needs.

As healthcare costs continue to rise, choosing the right insurance plan has become more critical than ever. First choice health insurance plans provide a balance of affordability, flexibility, and reliability, making them a popular option for those seeking long-term health security. With numerous providers offering tailored packages, it's crucial to understand what makes these plans exceptional and how they can cater to your specific requirements.

In this comprehensive guide, we'll explore everything you need to know about first choice health insurance plans, including their benefits, coverage options, and factors to consider when selecting the best plan for you. By the end of this article, you'll have a clear understanding of how these plans work and why they are an excellent investment in your health and well-being.

Read also:Iberia Comprehensive Health Center Your Ultimate Destination For Holistic Health And Wellness

Table of Contents

- Understanding First Choice Health Insurance Plans

- Key Benefits of First Choice Health Insurance Plans

- Exploring Coverage Options

- Understanding Costs and Premiums

- Eligibility Requirements

- How to Select the Best Plan

- Comparing First Choice Plans with Other Options

- Frequently Asked Questions

- Industry Statistics and Trends

- Sources and References

Understanding First Choice Health Insurance Plans

First choice health insurance plans are designed to provide comprehensive coverage for a wide range of medical needs. These plans are offered by reputable insurance providers and are tailored to meet the diverse requirements of individuals, families, and businesses. The core objective of these plans is to ensure that policyholders have access to quality healthcare services without worrying about excessive costs.

What Makes Them Unique?

First choice health insurance plans differ from other options in several key ways:

- They offer a wide network of healthcare providers.

- They include robust preventive care services.

- They provide flexibility in terms of coverage levels.

Whether you're seeking routine check-ups, specialized treatments, or emergency care, first choice plans ensure that you're covered when it matters most.

Key Benefits of First Choice Health Insurance Plans

One of the primary reasons people opt for first choice health insurance plans is the array of benefits they offer. These plans provide comprehensive coverage, financial protection, and peace of mind. Below are some of the most notable advantages:

Comprehensive Coverage

First choice plans cover a wide range of medical services, including:

- Hospitalization and surgery

- Prescription medications

- Maternity care

- Mental health services

Cost Savings

With first choice health insurance plans, you can save money on medical expenses. These plans often include negotiated rates with healthcare providers, reducing out-of-pocket costs for policyholders.

Read also:Army Requirements Age A Comprehensive Guide To Joining The Military

Exploring Coverage Options

First choice health insurance plans come in various forms, each catering to different needs. Understanding the options available is essential for making an informed decision.

HMO vs. PPO Plans

Two of the most common types of first choice health insurance plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs typically offer lower premiums but require you to stay within a specific network of providers. PPOs, on the other hand, provide more flexibility but may come with higher costs.

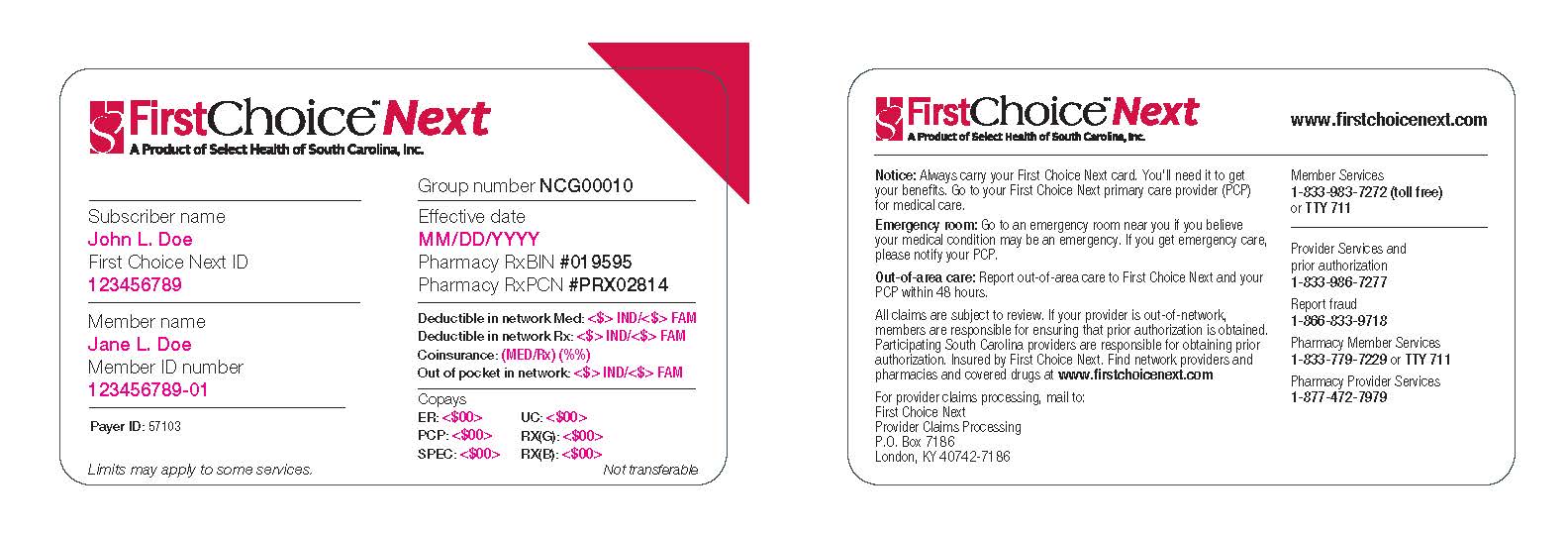

Understanding Costs and Premiums

When evaluating first choice health insurance plans, it's important to consider the associated costs. These include premiums, deductibles, co-payments, and out-of-pocket maximums. Understanding how these costs work can help you choose a plan that fits your budget.

Premiums

Premiums are the regular payments you make to maintain your health insurance coverage. First choice plans often offer competitive premiums, ensuring affordability for a wide range of individuals.

Eligibility Requirements

Before enrolling in a first choice health insurance plan, it's essential to understand the eligibility criteria. Factors such as age, income, and pre-existing conditions may affect your ability to qualify for certain plans.

Pre-Existing Conditions

Under the Affordable Care Act (ACA), insurance providers cannot deny coverage or charge higher premiums based on pre-existing conditions. This regulation ensures that individuals with chronic illnesses can still access first choice health insurance plans.

How to Select the Best Plan

Choosing the right first choice health insurance plan involves careful consideration of your healthcare needs and financial situation. Below are some steps to guide you through the selection process:

Assess Your Needs

Start by evaluating your medical history, lifestyle, and future healthcare requirements. Consider factors such as frequency of doctor visits, medication usage, and potential surgeries.

Compare Plans

Once you've identified your needs, compare different first choice health insurance plans to find the one that offers the best value. Look for plans with a strong provider network, comprehensive coverage, and affordable premiums.

Comparing First Choice Plans with Other Options

While first choice health insurance plans offer many advantages, it's important to compare them with other options to ensure you're making the best decision. Below are some alternatives to consider:

Short-Term Health Insurance

Short-term plans provide temporary coverage for individuals in transition. However, they often lack the comprehensive benefits of first choice plans and may not cover pre-existing conditions.

Frequently Asked Questions

What is the difference between first choice plans and traditional insurance?

First choice health insurance plans are designed to offer more flexibility and comprehensive coverage compared to traditional insurance. They often include additional benefits such as preventive care and mental health services.

Can I switch plans during the year?

Typically, you can only switch plans during the annual open enrollment period. However, certain life events, such as marriage or the birth of a child, may qualify you for a special enrollment period.

Industry Statistics and Trends

The health insurance industry is constantly evolving, with new trends shaping the market. According to a recent report by the Centers for Disease Control and Prevention (CDC), approximately 91.5% of Americans had health insurance coverage in 2022. First choice health insurance plans have played a significant role in increasing this coverage rate, offering accessible and affordable options to a broader audience.

Sources and References

This article draws information from reputable sources, including:

- Centers for Disease Control and Prevention

- U.S. Department of Health & Human Services

- American Hospital Association

Kesimpulan

First choice health insurance plans provide a reliable and comprehensive solution for individuals and families seeking quality healthcare coverage. With their wide range of benefits, flexible options, and competitive pricing, these plans are an excellent investment in your health and financial well-being. By understanding the key features and considerations outlined in this guide, you can make an informed decision when selecting the best plan for your needs.

We encourage you to take action by exploring available first choice health insurance plans and consulting with a trusted provider. Share your thoughts and experiences in the comments below, and don't forget to check out our other articles for more valuable insights on health and wellness.