Dependent pay military is a crucial aspect of military compensation, designed to support service members with additional financial assistance when they have dependents. It plays a vital role in ensuring that military families receive the financial stability they need to thrive. Understanding how dependent pay works and its implications can significantly impact the financial well-being of military families.

In today's world, financial security is paramount, especially for those serving in the military. Military personnel often face unique challenges, and having dependents adds another layer of complexity to their financial planning. This guide will delve into the intricacies of dependent pay military, exploring its benefits, requirements, and how it impacts military families.

By the end of this article, you'll have a thorough understanding of dependent pay military, empowering you to make informed decisions about your financial future. Whether you're a service member or a family member, this guide will provide valuable insights to help you navigate the complexities of military compensation.

Read also:Eagle Tattoo Ideas A Comprehensive Guide To Creating Your Perfect Tattoo

Table of Contents

- What is Dependent Pay Military?

- Eligibility Requirements for Dependent Pay

- Types of Dependent Pay

- How to Apply for Dependent Pay

- Tax Implications of Dependent Pay

- Benefits of Dependent Pay

- Common Mistakes to Avoid

- Frequently Asked Questions

- Resources for Further Learning

- Conclusion

What is Dependent Pay Military?

Dependent pay military refers to the additional compensation provided to military personnel who have dependents. This form of pay is designed to assist service members in meeting the financial needs of their families while serving in the military. Dependents typically include spouses, children, and sometimes other family members who rely on the service member for financial support.

Understanding the concept of dependent pay military is essential for anyone considering a career in the military or currently serving. It ensures that military families receive the necessary financial resources to maintain a stable and secure lifestyle. By providing additional income, dependent pay helps alleviate some of the financial burdens associated with military life.

Key Features of Dependent Pay

- Additional income for service members with dependents

- Supports the financial stability of military families

- Varies based on the number and type of dependents

Eligibility Requirements for Dependent Pay

To qualify for dependent pay military, service members must meet specific eligibility criteria. These requirements ensure that the pay is distributed appropriately to those who need it most. Below are the key eligibility factors:

Primary Eligibility Criteria

- Active-duty military status

- Verification of dependents through official documentation

- Compliance with military regulations and policies

Service members must provide proof of their dependents, such as birth certificates, marriage licenses, or adoption papers, to verify eligibility. This documentation is crucial in ensuring that dependent pay is awarded accurately and fairly.

Types of Dependent Pay

Dependent pay military comes in various forms, each tailored to meet the specific needs of military families. Understanding the different types of dependent pay can help service members maximize their benefits. Below are the primary types of dependent pay:

Basic Allowance for Housing (BAH)

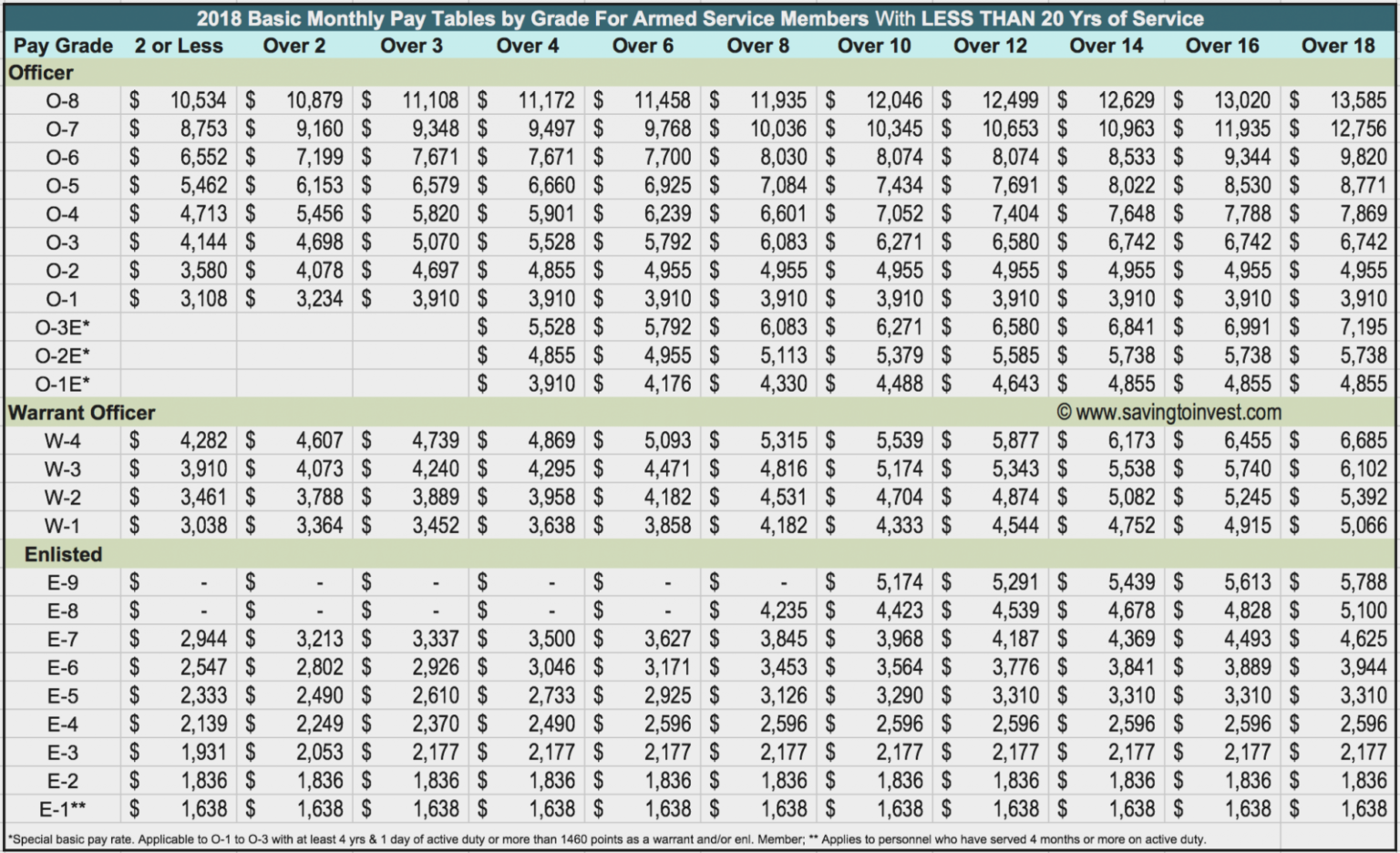

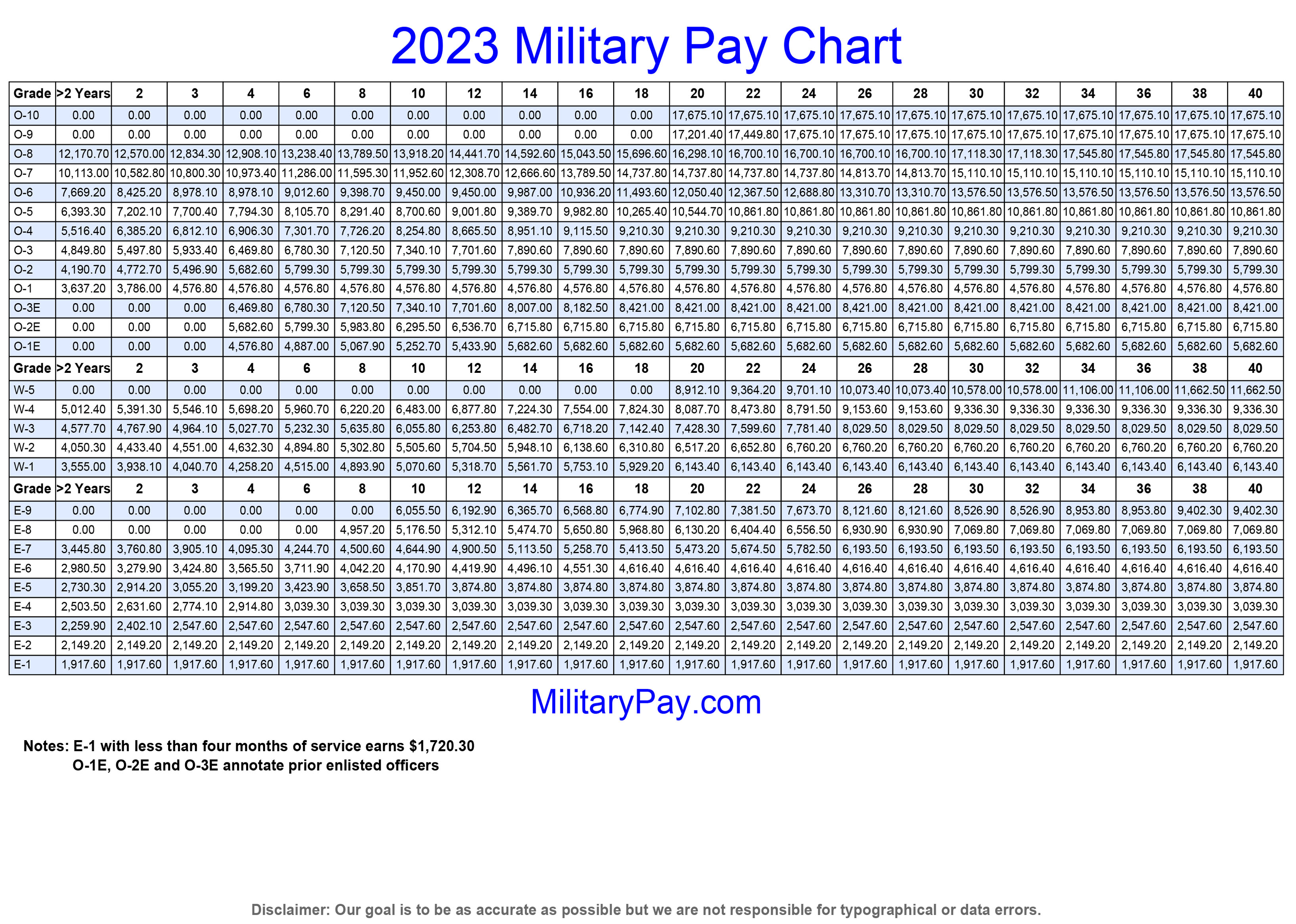

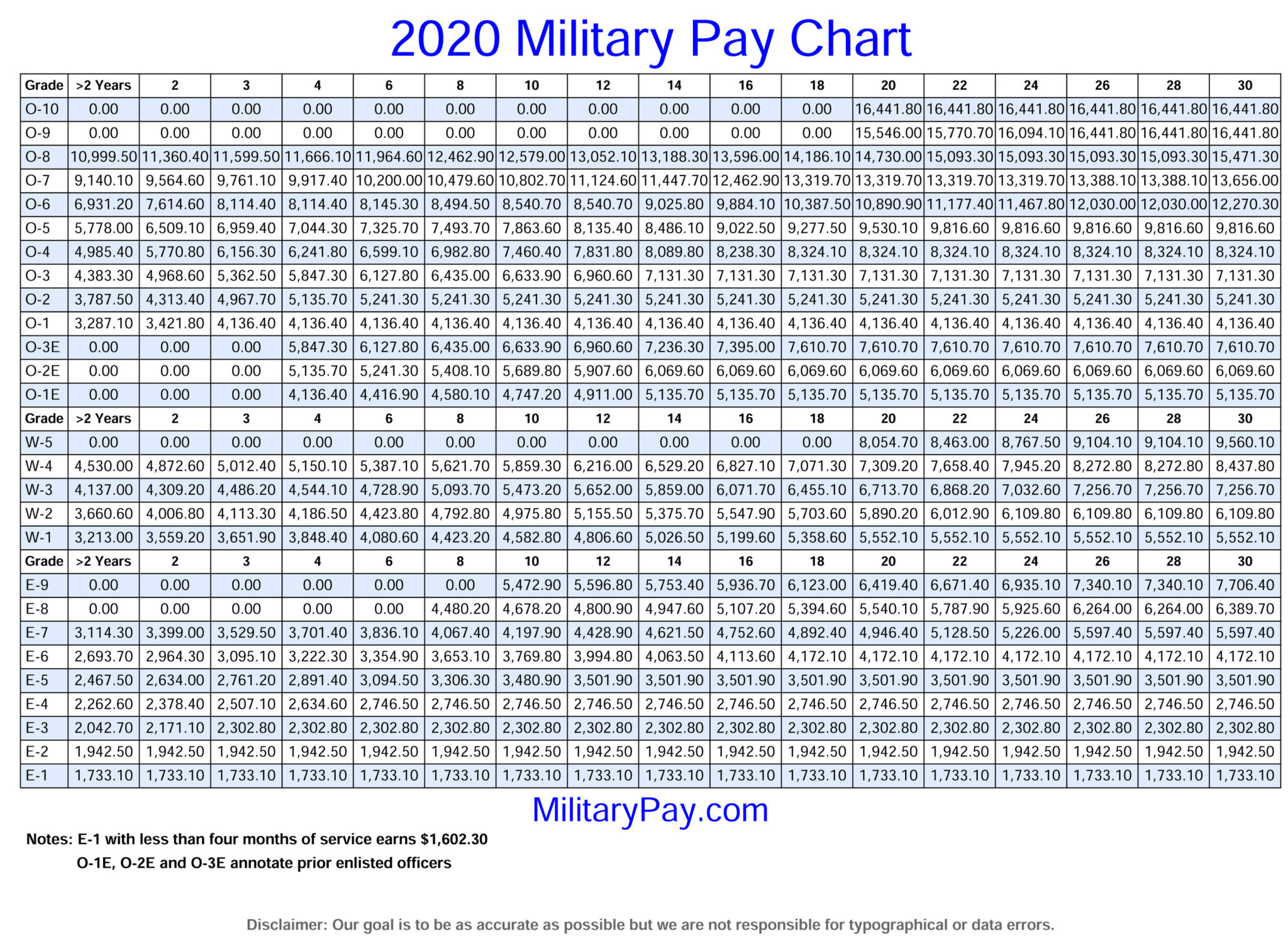

BAH is a housing allowance provided to service members with dependents. It is based on rank, location, and the number of dependents. BAH ensures that military families have access to affordable housing options, whether they live on or off base.

Read also:Max Age To Join The Air Force Exploring Your Path To A Rewarding Career

Family Separation Allowance (FSA)

FSA is awarded to service members who are separated from their dependents due to military duties. This allowance helps offset the additional costs associated with maintaining two households during periods of separation.

Additional Monthly Income

Some service members receive additional monthly income based on the number of dependents they support. This income is designed to cover the extra expenses incurred by having dependents.

How to Apply for Dependent Pay

Applying for dependent pay military involves several steps. Service members must ensure they have all the necessary documentation and follow the proper procedures to receive their benefits. Below is a step-by-step guide to applying for dependent pay:

Step 1: Gather Required Documentation

- Birth certificates for children

- Marriage license

- Adoption papers (if applicable)

Step 2: Submit Documentation to Your Chain of Command

Once all documentation is gathered, service members should submit it to their chain of command for verification. This process ensures that the information is accurate and up-to-date.

Step 3: Wait for Approval

After submission, service members must wait for approval from their commanding officer. This process may take several weeks, depending on the complexity of the case and the number of dependents involved.

Tax Implications of Dependent Pay

Dependent pay military has specific tax implications that service members should be aware of. Understanding how taxes affect dependent pay can help service members plan their finances effectively. Below are some key tax considerations:

Tax-Free Benefits

Some forms of dependent pay, such as BAH, are tax-free. This means that service members do not have to pay federal income tax on these benefits, providing additional financial relief.

Taxable Income

Other forms of dependent pay, such as additional monthly income, may be subject to federal income tax. Service members should consult with a tax professional to understand how taxes impact their overall compensation.

Benefits of Dependent Pay

Dependent pay military offers numerous benefits to service members and their families. These benefits extend beyond financial assistance, providing peace of mind and stability during challenging times. Below are some of the key benefits:

Financial Stability

Dependent pay ensures that military families have the financial resources needed to maintain a stable lifestyle. This stability is crucial for meeting basic needs such as housing, food, and education.

Improved Quality of Life

With additional income, service members can invest in their family's future, whether it's through education, healthcare, or leisure activities. This improved quality of life contributes to overall well-being and satisfaction.

Reduced Stress

Knowing that financial needs are met can significantly reduce stress levels for service members and their families. This reduction in stress allows for better focus on military duties and personal relationships.

Common Mistakes to Avoid

While dependent pay military is a valuable benefit, service members must avoid common mistakes that could jeopardize their eligibility or reduce their benefits. Below are some pitfalls to watch out for:

Failure to Update Documentation

Service members should regularly update their dependent documentation to reflect any changes in family status. Failure to do so could result in delayed or denied benefits.

Not Seeking Professional Advice

Consulting with financial advisors or tax professionals can help service members maximize their dependent pay benefits. Ignoring this advice could lead to missed opportunities or financial mismanagement.

Overlooking Tax Implications

Understanding the tax implications of dependent pay is crucial for effective financial planning. Service members should ensure they are aware of all tax-related issues to avoid unexpected liabilities.

Frequently Asked Questions

Below are some common questions about dependent pay military, along with their answers:

Q: Can retired military personnel receive dependent pay?

A: Retired military personnel may receive certain forms of dependent pay, such as retirement benefits for dependents. However, these benefits differ from active-duty dependent pay and are subject to different regulations.

Q: What happens if a service member's dependent status changes?

A: Service members must update their dependent status with their chain of command as soon as possible. Failure to do so could result in lost benefits or legal issues.

Q: Are there limits to the number of dependents a service member can claim?

A: There are no specific limits to the number of dependents a service member can claim, but each dependent must meet eligibility criteria and be properly documented.

Resources for Further Learning

For more information on dependent pay military, consider exploring the following resources:

Conclusion

Dependent pay military is a vital component of military compensation, providing essential financial support to service members with dependents. By understanding the eligibility requirements, types of dependent pay, and how to apply, service members can ensure they receive the maximum benefits available. Remember to stay informed about tax implications and seek professional advice when needed.

We encourage you to share this article with fellow service members and their families. Your feedback and questions are always welcome in the comments section below. For more insights into military benefits and compensation, explore our other articles on the website.